Single vs Duplicate Checks paper checks are still widely used. Whether you’re paying rent, covering a business expense, or sending money to a family member, checks remain a reliable and legally recognized payment method. But if you’ve ever ordered checks, you may have noticed two options: single checks and duplicate checks.

At first glance, the difference might not seem significant. Both serve the same basic purpose—allowing you to pay someone from your checking account. However, the choice between single and duplicate checks can have a major impact on how you track your finances, protect your information, and manage costs.

In this guide, we’ll take a deep dive into the world of single vs. duplicate checks. We’ll look at how each type works, their pros and cons, alternatives to using duplicate checks, and how to decide which option is right for you.

What Are Single Checks?

Single checks are exactly what they sound like—standard, standalone checks with no copy attached. Each check you write is the only version, meaning once you hand it to the payee, you have no built-in record of what you wrote.

If you want to keep track of your transactions, you’ll need to write down the details in your check register (the lined booklet often included with a check order). The check register lets you record the check number, date, payee, and amount.

Advantages of Single Checks

-

Less expensive: Single checks are usually cheaper than duplicate checks because they don’t require extra paper or carbon material.

-

Compact: A checkbook of singles is thinner and lighter, making it easier to carry in a purse, wallet, or pocket.

-

More secure: With no duplicate carbon copy to store, there’s less chance of sensitive information being stolen.

-

Ease of writing: Since there’s no carbon paper, you don’t need to press down hard with your pen to make an impression.

Disadvantages of Single Checks

-

No automatic record: If you forget to fill out your check register, you might lose track of who you paid and how much.

-

Greater reliance on memory: Single checks require you to be diligent about record-keeping to avoid overdrafts or missed payments.

-

Limited proof of payment: Without a duplicate, it can be harder to quickly show evidence of a transaction if there’s ever a dispute.

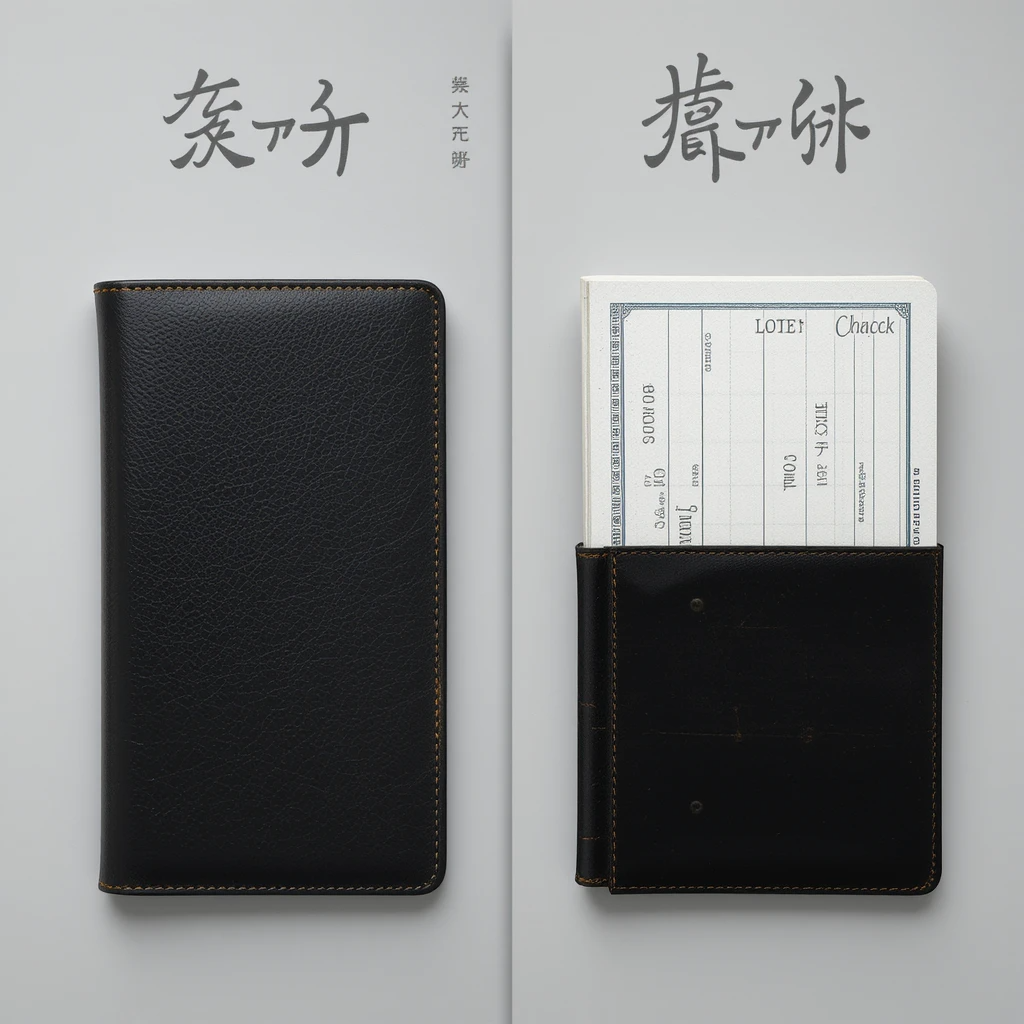

What Are Duplicate Checks?

Duplicate checks look just like single checks but come with a twist: behind every original check is a thin sheet of carbonless copy paper. When you write on the original check, the pressure from your pen creates an instant duplicate copy beneath it.

This copy stays in your checkbook as a permanent record of the check, while the original is given to the payee. The duplicate includes the date, payee, check number, amount, and even your signature.

Advantages of Duplicate Checks

-

Automatic record-keeping: Every check you write is automatically copied, reducing the risk of forgetting to record it.

-

Convenient for reconciliation: Having an exact copy of every check makes it easier to compare your checkbook with your bank statement.

-

Proof of payment: If there’s ever a dispute over whether you paid someone, the duplicate copy can serve as evidence.

-

Great for budgeting: Reviewing your duplicates can help you track spending habits and stay on top of finance.

Disadvantages of Duplicate Checks

-

Higher cost: Duplicate checkbooks are bulkier and more expensive than singles.

-

More space required: A duplicate checkbook contains twice the paper, making it heavier to carry around.

-

Security risks: Since duplicates contain all your payment information, losing your checkbook could expose you to fraud.

-

Harder to write: You must press firmly with your pen to ensure the writing transfers clearly to the duplicate copy.

How Duplicate Checks Work

The secret behind duplicate checks lies in carbonless copy paper. Unlike the old-fashioned carbon paper that left messy black smudges, modern duplicate checks use a thin sheet coated with micro-encapsulated dye or clay. When you press down with a pen, the dye bursts and transfers your writing to the duplicate sheet.

Each duplicate is attached behind the original check in your checkbook, aligned perfectly. After writing a check, the original tears out for use, while the duplicate remains behind in your register.

This system ensures that every detail—including payee, amount, date, and signature—is mirrored on the duplicate. That way, you don’t have to spend time manually recording transactions.

Single vs. Duplicate Checks: A Side-by-Side Comparison

Here’s a quick breakdown of the differences:

| Feature | Single Checks | Duplicate Checks |

|---|---|---|

| Cost | Cheaper | More expensive |

| Bulk | Thinner, lighter | Bulkier, heavier |

| Record-Keeping | Must be done manually | Automatic duplicate copy |

| Security | Less risk (no duplicate info stored) | Higher risk if checkbook is stolen |

| Ease of Use | Easy to write, no extra pressure | Must press hard to transfer info |

| Best For | Occasional check writers, security-conscious users | Frequent check writers, business owners, budget trackers |

Who Should Use Single vs Duplicate Checks?

Single checks may be the better option if:

-

You rarely write checks and don’t need extensive records.

-

You’re concerned about security and want fewer physical records of your financial transactions.

-

You prefer a lighter, smaller checkbook that’s easier to carry.

-

You want to save money by avoiding the higher cost of duplicate checks.

Who Should Use Duplicate Checks?

Duplicate checks are ideal if:

-

You write checks frequently, such as for bills, rent, or payroll.

-

You want a simple way to keep records without using a check register.

-

You need to track spending for budgeting or tax purposes.

-

You value the peace of mind of having a backup copy in case of disputes.

Pros and Cons of Duplicate Checks at a Glance

Pros

-

Built-in record keeping

-

Easier reconciliation with bank statements

-

Proof of payment for disputes

-

Helpful for budgeting and taxes

Cons

-

Costlier than single checks

-

Bulkier checkbooks

-

Potential security risks if not stored properly

-

Requires pressing hard while writing

Alternatives to Duplicate Checks

In today’s digital-first financial world, many people don’t rely on duplicate checks at all. Instead, they use tools that achieve the same goal—keeping track of financial records—without paper.

Here are some popular alternatives:

-

Online Banking

-

Most banks provide detailed transaction histories online. You can view payments, download images of cleared checks, and reconcile statements digitally.

-

-

Budgeting Apps

-

Apps like Mint, YNAB (You Need a Budget), or Personal Capital let you categorize expenses and track income automatically.

-

-

Accounting Software

-

Tools like QuickBooks or FreshBooks are great for small businesses that need to manage payroll, invoices, and expenses.

-

-

Excel or Google Sheets

-

If you prefer manual control, you can create your own spreadsheet to record payments. Many free templates exist online.

-

-

Digital Check Copies

-

Many banks offer digital images of cleared checks, which serve as proof of payment just like physical duplicates.

-

Security Tips for Using Duplicate Checks

If you choose duplicate checks, it’s important to protect your sensitive financial information:

-

Store checkbooks securely: Keep them in a locked drawer, safe, or cabinet.

-

Dispose of duplicates properly: Shred old duplicates instead of throwing them in the trash.

-

Restrict checks: Write “For deposit only” on the endorsement line to prevent unauthorized deposits.

-

Monitor accounts regularly: Check your statements frequently to spot fraud early.

How Long Should You Keep Duplicate Checks?

The IRS recommends keeping financial records related to tax-deductible expenses for at least 7 years. If you wrote a check for something that may have tax implications—like home improvements, charitable donations, or business expenses—keep the duplicate for that long.

Single vs Duplicate Checks, you can safely dispose of duplicates once the check has cleared and the payment is confirmed.

Proper Disposal of Duplicate Checks

When it’s time to get rid of old duplicate checks, don’t just toss them in the trash. Each duplicate contains sensitive information like your bank account number, payee, and signature.

Safe disposal methods include:

-

Shredding: Use a cross-cut shredder to destroy duplicates.

-

Burning: If permitted in your area, burning ensures total destruction.

-

Professional destruction services: Many offices or banks offer secure document disposal services.

Are Duplicate Checks Worth It?

The answer depends on your habits. If you rarely use checks and rely on digital banking, duplicate checks may not be necessary. But if you’re a frequent check writer—especially for business or record-keeping purposes—the convenience of duplicates can outweigh their extra cost and bulk.

Think of duplicate checks as a trade-off between convenience and cost:

-

If you want the easiest way to keep records, duplicates are worth it.

-

If you want the cheapest, most secure option, singles may be better.

Key Takeaways

-

Single checks are cheaper, lighter, and more secure but require manual record-keeping.

-

Duplicate checks automatically create a copy for each transaction, making them great for organization but costlier and bulkier.

-

The right choice depends on how often you write checks, how much you value convenience, and how concerned you are about security.

-

Alternatives like online banking, budgeting apps, and accounting software may replace the need for duplicate checks altogether.

-

If you do use duplicates, store them securely and shred them once you no longer need them.

Final Thoughts

While checks may seem old-fashioned compared to online transfers and mobile payments, they remain an important financial tool. Choosing between single and duplicate checks comes down to your lifestyle, financial habits, and comfort with record-keeping.

If you only write the occasional check, single checks are usually enough. But if you write checks often and want an effortless way to stay organized, duplicate checks can provide peace of mind—at a slightly higher cost.

Either way, understanding the differences helps you make the best decision for your financial management style.https://wislay.net/