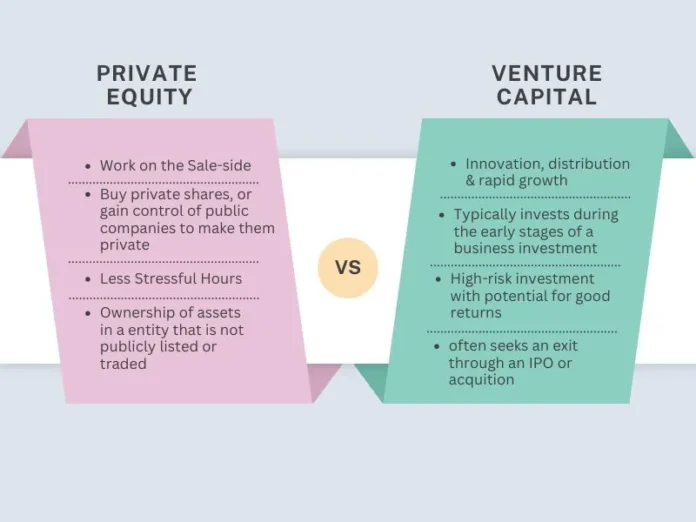

When people hear terms like “private equity” and “venture capital,” they often think they mean the same thing. It’s easy to get confused because both involve investing money in companies that aren’t listed on the stock market. But while they may look similar on the surface, they work in very different ways.

In this blog, we’ll break it all down in a friendly and straightforward way. Whether you’re an investor, business owner, or just someone curious, you’ll walk away the difference of private equity and venture capital .

First, Let’s Talk About What They Have in Common

Before jumping into the differences, it helps to understand what connects these two. Both private equity and venture capital involves.

- Involve investing in private companies (i.e., companies not traded on public stock exchanges).

- Aim to grow the value of those companies over time.

- Usually require a longer-term commitment — years, not months.

- Expect a return on investment (ROI) either when the company gets sold, goes public, or reaches a significant milestone.

That’s where the similarities mostly end. From here on out, the two paths take very different routes.

What Is Private Equity?

Private equity is all about buying existing companies, usually ones that are already profitable or at least stable. Private equity firms typically invest large amounts of money — sometimes hundreds of millions of dollars — to take control of a company. In many cases, they even buy the whole company outright.

How It Works:

Private equity firms raise money from big investors (like pension funds, insurance companies, or wealthy individuals). This money goes into a fund, which is then used to buy companies. The idea is to improve the business by cutting costs, increasing efficiency, or restructuring operations, and then selling it later for a higher price.

It’s a little like flipping houses, but on a much bigger and more complex level.

What Is Venture Capital?

Venture capital focuses on new business and early-stage businesses. These are companies that usually have a new product, a unique idea, or a fresh approach — but not a lot of cash. Many of them aren’t profitable yet.

VCs step in early, providing funding to help these startups grow. In return, they get a percentage of ownership. Venture capitalists don’t usually take over the whole company. Instead, they partner with the founders and often offer guidance and networking support along with the money.

Private Equity and Venture Capital Key Differences

Let’s look at how these two investment types stack up against each other across several categories:

1. Stage of Business

- Private Equity: Invests in mature, established businesses. These companies already have a working model, customers, and usually make a profit.

- Venture Capital: Invests in startups or early-stage companies. These businesses are still figuring things out and often need cash to grow.

2. Ownership Level

- Private Equity: Often buys the entire company or a controlling stake (more than 50%). They want full control to make changes.

- Venture Capital: Buys a smaller piece of the company, often 10% to 30%. They don’t want complete control but aim to support the founders.

3. Investment Size

- Private Equity: Deals are big. Investments often range from tens of millions to billions of dollars.

- Venture Capital: Deals can be much smaller. Early rounds might be a few hundred thousand to a couple of million dollars.

4. Risk Level

- Private Equity: Less risky, generally. The companies are already functioning businesses.

- Venture Capital: Riskier, since startups can easily fail. But if they succeed, the returns can be massive.

5. Involvement

- Private Equity: Usually very hands-on. They might change leadership, cut staff, or change how the company runs.

- Venture Capital: More supportive. They act as advisors and mentors rather than stepping in to run things.

Real-Life Example: Private Equity

Imagine a company that makes home appliances. It’s been around for 20 years, has factories, customers, and decent sales, but growth has stalled. A private equity firm sees potential. They buy the company, bring in new managers, streamline operations, reduce waste, and boost online sales.

Five years later, they sell the company at a much higher value. Everyone involved (including the investors in the fund) makes a profit.

Real-Life Example: Venture Capital

Now, picture a small team building an app that helps people manage personal finances. They have a great idea and a prototype, but no money to scale. A venture capital firm likes the idea and gives them $1 million in funding.

The team uses the money to hire engineers, build the app, and market it. If the app becomes popular and gets acquired by a bigger tech company, the VC firm earns a nice return on its original investment.

Which One Is Better?

There’s no simple answer — it depends on your goals.

- If you’re a business owner with a mature company looking to sell or grow aggressively, private equity might be a better fit.

- If you’re a startup founder looking to raise your first big round of funding, venture capital is more your path.

For investors, it also depends on how much risk you’re willing to take. Private equity is usually more stable, while venture capital offers the chance of big rewards (but with significant risks too).

How Do PE and VC Firms Make Money?

Both private equity and venture capital firms usually earn in two main ways:

- Management Fees – They charge a fee (often around 2%) to manage the money in their fund.

- Carried Interest (Profit Share) – When they successfully exit an investment, they take a percentage of the profits (often 20%).

This model encourages them to grow the businesses they invest in and deliver strong results.

Common Misunderstandings

Let’s clear up a few things people often get wrong:

- They’re not the same thing. Just because they both deal with private companies doesn’t mean they do the same work.

- VCs don’t always invest in tech. While many do, venture capital can also go to health care, education, or other sectors.

- PE firms don’t always “cut and sell.” While they often focus on restructuring, some PE firms also invest in growth and innovation.

Final Thoughts

If you know the difference between private equity and venture capital it isn’t just useful for investors or business owners. It also gives you insight into how companies grow, how money flows through the economy, and who’s behind many of the products and services we use every day.

Both PE and VC play essential roles in shaping the business world. One focuses on improving existing companies, the other on bringing bold new ideas to life. Neither is better because both have different purposes.